Ship-T Helps To Implement The Destination Based Tax Scheme in Dynamics RMS

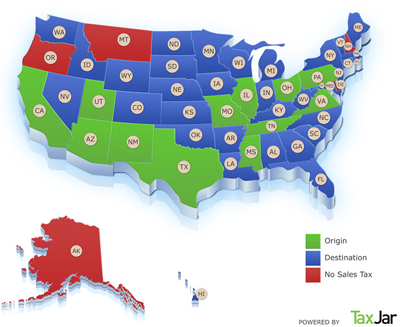

Ship-T for Dynamics RMS addresses the issue of a particular sales tax legislation - so called destination-based sales tax. In the jurisdictions where the origin-based tax is used, the tax charged on a sales transaction depends only on the merchant's location. But in destination-based tax jurisdictions, the tax charged depends on whether the product sold at the store, or shipped to anther location. This article explains the issued in more detail.

The legislation requires that if a purchased item is shipped from the store by mail, the destination tax needs to be charged. However, when the same customer walks in the store and purchases the item in person, the store's local tax applies. Dynamics RMS provides no such flexibility as it allows to set default taxes on per-customer basis or treat everyone as a walk-away customer - without consideration of whether shipping is included or not.

In real life, the destination-based sales taxes may be many and change frequently. For example, in Washington State alone there's one state tax and over 350 "location code" taxes. See Destination-Based Sales Tax in WA State for more information. In that jurisdiction the location code taxes change every 3 months. If a store which uses RMS , requires both shipped and walk-in orders for the same customers, maintaining such number of different taxes becomes almost impossible.

Ship-T for Dynamics RMS help to overcome this issue. If the import file is available, Ship-T will automatically create or update the corresponding sales and item taxes in Dynamics RMS. This process may be repeated every time the sale taxes change. Even if you manage just few "out-of-state", or zip-code based destinations taxes, Ship-T becomes invaluable as it applies the correct tax based on whether a shipping service was selected